Your Seller refuses to release earnest money images are ready in this website. Seller refuses to release earnest money are a topic that is being searched for and liked by netizens today. You can Download the Seller refuses to release earnest money files here. Find and Download all free photos.

If you’re looking for seller refuses to release earnest money pictures information connected with to the seller refuses to release earnest money interest, you have visit the right site. Our website frequently gives you hints for downloading the highest quality video and picture content, please kindly surf and locate more informative video articles and graphics that match your interests.

Seller Refuses To Release Earnest Money. Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property. Technically when money is held in. If they refuse to sign the mutual release then you are going to have to play hardball and probably talk with an attorney. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount.

What Is Earnest Money And How Does It Work Propertynest From propertynest.com

What Is Earnest Money And How Does It Work Propertynest From propertynest.com

Failure or refusal of a Buyer or Seller to release the earnest money in the face of a clear contractual obligation to do so can result in severe consequences. It is easy for a lazy seller to decline to authorize the release of earnest. Todd gives some tips for what to do if a seller is refusing to return your Earnest Money Deposit also known as EMD. The attorney would file this cancellation and the Broker holding your earnest money would legally have to return your earnest money even if no cancellation of the. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount. There is no deadline on termination paperwork and they could sit on that and our earnest money indefinitely.

The answer depends on the terms of the sales contract.

The buyer may terminate under an option contained in the contract financing may not be available under agreed upon terms the buyers circumstances may change or the seller may refuse to cure some title defect. The seller is upset and wont sign the TAR Release of Earnest Money form. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount. It is easy for a lazy seller to decline to authorize the release of earnest. Consider the following steps. Even in contracts which contain an unrestricted right for the purchaser to terminate the contract title companies or escrow agents may require the parties to execute a Release.

Source: propertynest.com

Source: propertynest.com

The brokers disbursement of earnest money is not the final say. Parties to a failed real estate contract that results in an earnest money dispute are wise to secure the services of an experienced real estate attorney. Of course on the flip side this seller cannot do anything with that property as long as there is a binding. Named defendants should include the party refusing to sign the release and the title company holding the earnest money. The attorney would file this cancellation and the Broker holding your earnest money would legally have to return your earnest money even if no cancellation of the.

Source: thegoodhartgroup.com

Source: thegoodhartgroup.com

OH No clear title Seller refuses to release earnest money House burns I signed a contract for a home in February of this year. Of course on the flip side this seller cannot do anything with that property as long as there is a binding. The attorney would file this cancellation and the Broker holding your earnest money would legally have to return your earnest money even if no cancellation of the. The buyer or seller would have to sue the other not the brokers in order to receive the earnest money deposit. Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property.

Source: growatlantahomes.com

Source: growatlantahomes.com

Typically the buyer places an earnest money deposit and in some instances the contract contains a. Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount. We use the mutual release and it terminates the contract and stipulates what happens with the earnest money. The broker must send the buyer and seller notice of the plan and if either buyer or seller disagree with the broker may file a lawsuit to obtain a court order for disbursement.

Source: coloradodreamhouse.com

Source: coloradodreamhouse.com

Consider the following steps. Parties to a failed real estate contract that results in an earnest money dispute are wise to secure the services of an experienced real estate attorney. Named defendants should include the party refusing to sign the release and the title company holding the earnest money. The brokers disbursement of earnest money is not the final say. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount.

Source: toddmillertv.com

Source: toddmillertv.com

The agreement between the seller and the buyer could remove the power of the sellers refusal to authorize refund of the earnest money by requiring the escrow agent or whoever is holding the funds to refund the earnest money to the buyer unless the seller initiates a lawsuit to retrieve the earnest money by a clear deadline. When contracts do fall apart disposition of the Earnest Money may be disputed. OH No clear title Seller refuses to release earnest money House burns I signed a contract for a home in February of this year. Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property. We use the mutual release and it terminates the contract and stipulates what happens with the earnest money.

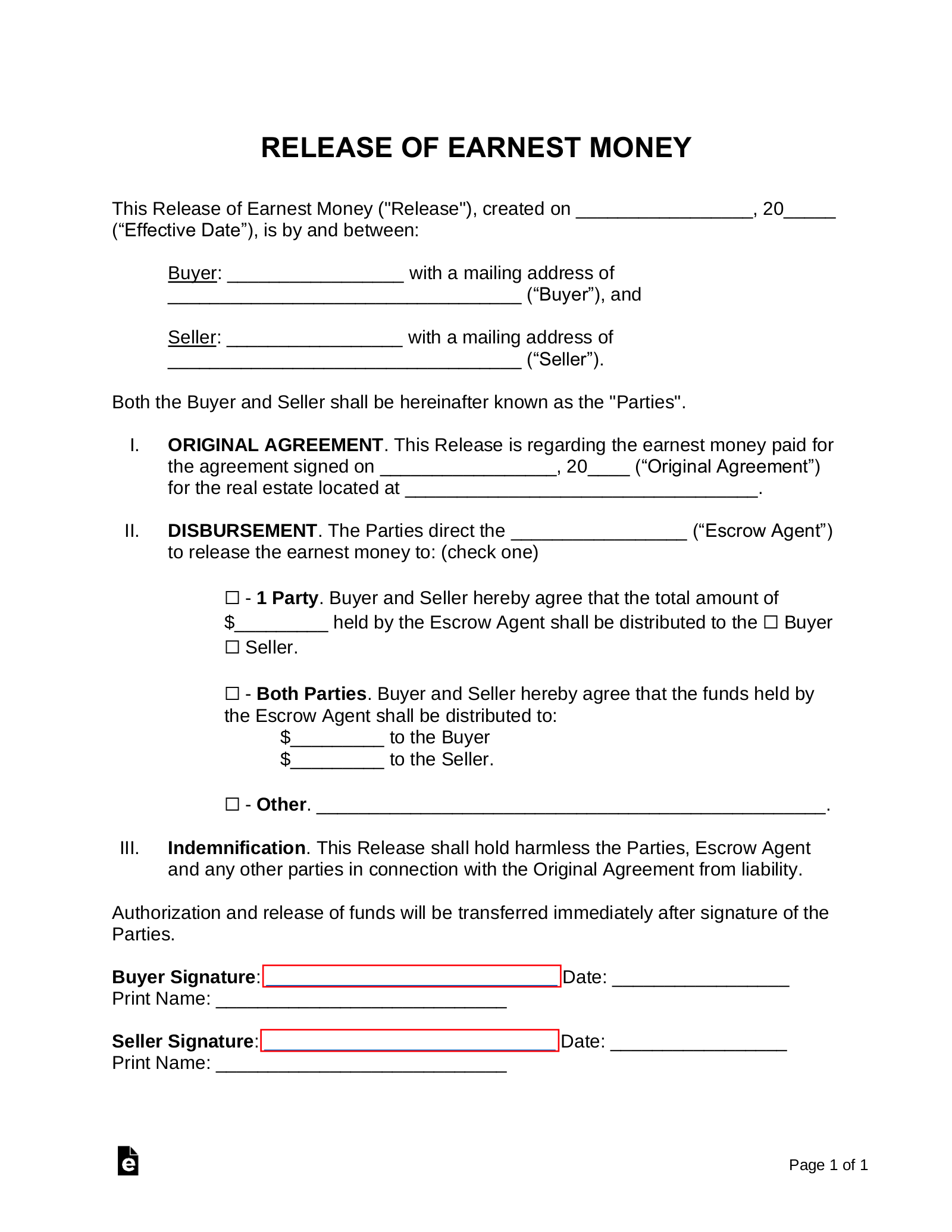

Source: doctemplates.net

Source: doctemplates.net

If the buyer objects to this idea the seller may offer to put a signed deed in escrow pointing out that he has then done. But in this instance the earnest money would not be received back by the buyer if the seller refused to sign the release of earnest money. Todd gives some tips for what to do if a seller is refusing to return your Earnest Money Deposit also known as EMD. Parties to a failed real estate contract that results in an earnest money dispute are wise to secure the services of an experienced real estate attorney. Buyer could terminate because the believe the seller is in breach and then the contract is terminated and the seller would have no problem re-listing the house.

Source: doctemplates.net

Source: doctemplates.net

There is no deadline on termination paperwork and they could sit on that and our earnest money indefinitely. Typically the buyer places an earnest money deposit and in some instances the contract contains a. Named defendants should include the party refusing to sign the release and the title company holding the earnest money. Todd gives some tips for what to do if a seller is refusing to return your Earnest Money Deposit also known as EMD. Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property.

Source: checkmyhousesvalue.com

Source: checkmyhousesvalue.com

The realtor says shes doesnt know if the new buyer has put down earnest money that thats privileged info. 20 2015 Under the provisions of Paragraph 18 of the contract your client could make a written demand to the escrow agent that the earnest money be released. The broker is only holding the money as an escrow agent for the parties. If they refuse to sign the mutual release then you are going to have to play hardball and probably talk with an attorney. It is easy for a lazy seller to decline to authorize the release of earnest.

Source: homelight.com

Source: homelight.com

20 2015 Under the provisions of Paragraph 18 of the contract your client could make a written demand to the escrow agent that the earnest money be released. The buyer may terminate under an option contained in the contract financing may not be available under agreed upon terms the buyers circumstances may change or the seller may refuse to cure some title defect. What can my buyer do to get her earnest money. The seller is upset and wont sign the TAR Release of Earnest Money form. To condense the story I had about 3 - 4 closing dates throughout the spring that all passed for various reasons seller needing time to move waiting on.

Source: pinterest.com

Source: pinterest.com

The buyer or seller would have to sue the other not the brokers in order to receive the earnest money deposit. Title companies will usually respond by interpleading the earnest money depositing it into the courts account which removes them from the merits of the litigation. Typically the buyer places an earnest money deposit and in some instances the contract contains a. It is easy for a lazy seller to decline to authorize the release of earnest. The buyer or seller would have to sue the other not the brokers in order to receive the earnest money deposit.

Source: realtor.com

Source: realtor.com

The realtor says shes doesnt know if the new buyer has put down earnest money that thats privileged info. Failure or refusal of a Buyer or Seller to release the earnest money in the face of a clear contractual obligation to do so can result in severe consequences. We use the mutual release and it terminates the contract and stipulates what happens with the earnest money. The attorney would file this cancellation and the Broker holding your earnest money would legally have to return your earnest money even if no cancellation of the. Of course on the flip side this seller cannot do anything with that property as long as there is a binding.

Source: sammamishmortgage.com

Source: sammamishmortgage.com

OH No clear title Seller refuses to release earnest money House burns I signed a contract for a home in February of this year. In many cases the earnest money is low enough that the parties can file a case in small claims court. The buyer may terminate under an option contained in the contract financing may not be available under agreed upon terms the buyers circumstances may change or the seller may refuse to cure some title defect. Of course on the flip side this seller cannot do anything with that property as long as there is a binding. The broker is only holding the money as an escrow agent for the parties.

Source: sanantoniorealestatelawyer.com

Source: sanantoniorealestatelawyer.com

Typically the buyer places an earnest money deposit and in some instances the contract contains a. Parties to a failed real estate contract that results in an earnest money dispute are wise to secure the services of an experienced real estate attorney. To condense the story I had about 3 - 4 closing dates throughout the spring that all passed for various reasons seller needing time to move waiting on. The buyer or seller would have to sue the other not the brokers in order to receive the earnest money deposit. Now most agents will not have the Buyer send the notification letter but send the Release_Cancellation form and IF the Seller signs it then no foul and truly no harm But what if the Seller refuses to sign the form Then we are in a sticky area as far as the Escrow Funds are concerned The Escrow Agent should not disperse the funds without identical instructions from all.

Source: southernathena.com

Source: southernathena.com

The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount. The broker must send the buyer and seller notice of the plan and if either buyer or seller disagree with the broker may file a lawsuit to obtain a court order for disbursement. If the buyer objects to this idea the seller may offer to put a signed deed in escrow pointing out that he has then done. The broker is only holding the money as an escrow agent for the parties. To condense the story I had about 3 - 4 closing dates throughout the spring that all passed for various reasons seller needing time to move waiting on.

Source: usdaloan.org

Source: usdaloan.org

Realtors supervisor said sellers cannot sell house while holding our money that two earnest money deposits from different buyers cannot be held on the same property. Buyer could terminate because the believe the seller is in breach and then the contract is terminated and the seller would have no problem re-listing the house. 20 2015 Under the provisions of Paragraph 18 of the contract your client could make a written demand to the escrow agent that the earnest money be released. Your question specifically asks whether it is legal for the seller to refuse to release your earnest money deposit. In a hot market the seller will sometimes ask to have the earnest money deposit released to him after the contingencies have been satisfied.

Source: eforms.com

Source: eforms.com

Now most agents will not have the Buyer send the notification letter but send the Release_Cancellation form and IF the Seller signs it then no foul and truly no harm But what if the Seller refuses to sign the form Then we are in a sticky area as far as the Escrow Funds are concerned The Escrow Agent should not disperse the funds without identical instructions from all. Even in contracts which contain an unrestricted right for the purchaser to terminate the contract title companies or escrow agents may require the parties to execute a Release. 20 2015 Under the provisions of Paragraph 18 of the contract your client could make a written demand to the escrow agent that the earnest money be released. The broker is only holding the money as an escrow agent for the parties. Parties to a failed real estate contract that results in an earnest money dispute are wise to secure the services of an experienced real estate attorney.

Source: johnsonandwilson.com

Source: johnsonandwilson.com

When contracts do fall apart disposition of the Earnest Money may be disputed. Where the Buyer has defaulted the Seller is entitled to receive the earnest money. The subject today is What to do if the seller wont release you earnest money deposit Example you go under contract to buy a house and one of the first thing you do is write a check for earnest money usually a couple grand or maybe 1 of the purchase price some amount nominal amount. We use the mutual release and it terminates the contract and stipulates what happens with the earnest money. The seller is upset and wont sign the TAR Release of Earnest Money form.

Source: ericstewartgroup.com

Source: ericstewartgroup.com

The agreement between the seller and the buyer could remove the power of the sellers refusal to authorize refund of the earnest money by requiring the escrow agent or whoever is holding the funds to refund the earnest money to the buyer unless the seller initiates a lawsuit to retrieve the earnest money by a clear deadline. The realtor says shes doesnt know if the new buyer has put down earnest money that thats privileged info. The buyer or seller would have to sue the other not the brokers in order to receive the earnest money deposit. What can my buyer do to get her earnest money. Of course on the flip side this seller cannot do anything with that property as long as there is a binding.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title seller refuses to release earnest money by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.